By Anthony Candeias, CISO, Professor, Advisor

The race to dominate artificial intelligence is no longer just about algorithms, it's about hardware. The battle over GPUs, advanced semiconductors, and manufacturing equipment has become a defining front in the evolving strategic rivalry between the United States and China. What was once a competition over innovation is now a geopolitical struggle for control of the computational engines that power the future.

Semiconductors as Strategy

Artificial intelligence today runs on silicon. Chips like Nvidia’s A100 and H100 GPUs are the backbone of large-scale model training. For U.S. policymakers, retaining leadership in semiconductor design and manufacturing is a national imperative. In response, Washington has employed a multi-pronged strategy: restrict adversarial access, subsidize domestic capability, and align global allies.

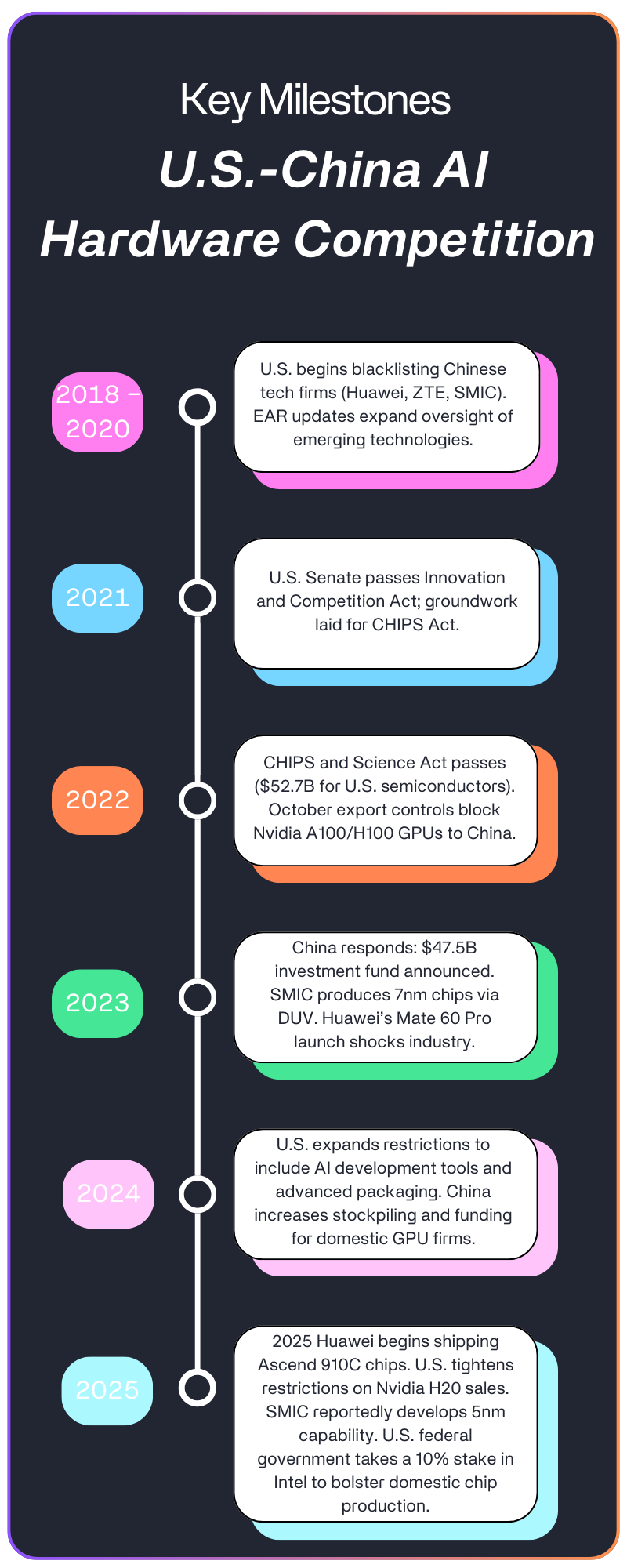

Beginning in 2022, the Biden administration implemented sweeping export controls to block China’s access to the most advanced chips and manufacturing equipment. The CHIPS and Science Act earmarked $52.7 billion to rebuild the U.S. semiconductor ecosystem. The U.S. also leaned on its geopolitical leverage, securing agreements with the Netherlands and Japan to limit China’s access to key lithography tools, such as ASML’s EUV machines.

China has not stood still. In response to sanctions, it has poured capital and talent into domestic alternatives. In 2023, Semiconductor Manufacturing International Corporation (SMIC) stunned industry watchers by producing 7nm chips using older DUV tools—technology thought to be generations behind. Huawei followed with competitive AI chips such as the Ascend 910C and its Mate 60 Pro smartphone, signaling resilience despite constraints. Beijing’s 2024 announcement of a $47.5 billion injection into the sector reaffirms a clear directive: achieve 70% semiconductor self-sufficiency by 2030.

Strategic Competition, Economic Disruption

This technological rivalry is already reshaping global markets. U.S. companies like Nvidia, once reliant on China for significant revenue, now face estimated losses ranging from $5.5 to $17.8 billion due to the export bans. Supply chains are fragmenting as Chinese firms turn to intermediaries and alternative ecosystems, prompting the U.S. to extend enforcement to third-party nations like Malaysia and the UAE. At the same time, Washington has moved to further shore up its domestic industry: the federal government recently acquired a 10% stake in Intel, underscoring semiconductors’ status as strategic infrastructure. Beyond immediate financial implications, the move reflects an effort to stabilize U.S. chip production and reduce reliance on external supply chains.

For allies, the dilemma is delicate. The Netherlands, home to ASML, must balance strategic alignment with the U.S. against its commercial interests. Gulf nations that partnered with Chinese AI firms for digital transformation face new constraints. And nations across the Global South may soon be forced to choose sides in an increasingly bifurcated tech landscape.

Ironically, the more Washington restricts, the more it may accelerate Beijing’s domestic innovation. If China succeeds in scaling advanced manufacturing—particularly with recent signs of 5nm progress—export controls could have the unintended effect of fueling long-term competition rather than curtailing it.

The long-term implications are that three core realities now define the AI arms race:

- Hardware is the chokepoint. Data and talent matter, but without computational power, breakthroughs stall. AI hardware is now central to economic growth and military preparedness.

- Export controls are strategic weapons. The U.S. has weaponized the semiconductor supply chain with precision. Yet enforcement gaps and global dependencies make this strategy difficult to sustain at scale.

- China’s catch-up curve is compressing. The country’s ability to leapfrog technological barriers—especially under constraint—should not be underestimated.

Milestones such as Huawei’s 910C shipments in May 2025 and SMIC’s rumored 5nm progress illustrate the momentum behind China’s efforts. The United States still leads, but that lead is shrinking. Unless it can sustain innovation and coordinate policy across sectors and allies, it risks ceding the long-term advantage.

What began as an economic contest is now a struggle over digital sovereignty. The future of artificial intelligence will be shaped not only by those who build the smartest models—but by those who control the chips they run on.